From the Blackboard to the Stock Exchange LED Display

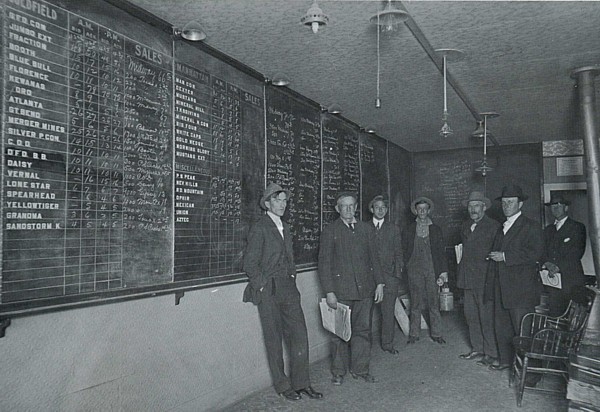

It was the second half of the XIX century, and the world’s stock exchanges still needed a person to grab a piece of chalk, get up on a ladder and handwrite all the quotes and transactions of the day on a huge blackboard. As the years went by, technological progress contributed to the evolution of stock markets, replacing what was done manually, with electronic displays.

Time also brought about a set of regulations that guaranteed the legality, security, and transparency of the mechanisms, for the smooth development of securities trading -based on fixed and known real-time prices- in a safe environment conducive to investments. However, beyond regulation, security, transparency, and even spontaneity, electronic systems and digital displays offered innovation and progress thus the world’s stock exchanges gradually incorporated them.

It is interesting to see how these displays have evolved and taken on new meanings throughout history, by expanding their potentialities and features and offering innovative and sustainable performance to the stock markets and the financial community in general.

In the 70s, 80s, and 90s, displays featured systems that made it possible to disseminate information in real-time at the Trading Hall, which was crucial for in situ decision-making. That is to say, to act, investors had to be physically present in the hall. Hence, those famous stock exchange floor images came into being where you saw hundreds of traders running and yelling everywhere.

The Advent of the Internet and Mobile Devices

With the advent of the Internet and mobile devices in the 90s, it was no longer necessary for investors or brokers to be present in the Trading Hall to monitor the information in real time. Most of the operations could be remotely performed through computer connections. This pushed the stock exchanges’ need to disseminate information in real-time through large displays, into the background, since attention turned to the Internet and the digital revolution taking place.

The end of the need for physical interaction, and the emergence of the virtual communication opportunity resulted in an expansion trend for the channels to establish business relationships, and the financial market was not exempt from this. When it comes to multi-channel and omnichannel, this refers to a phenomenon that offered a wide range of opportunities for companies to interact with clients, shareholders, investors, etc.

At that time, stock exchanges introduced tri-color displays to make their operations visible, some of which were replaced with the LED displays that we know today.

Technological Evolution

It is worth mentioning that terms of great significance, such as transparency, data dissemination (now known as dissemination of information), and even innovation itself, resulted in a certain technological evolution for this market. This evolution replaced the tri-color display systems, delivering broad benefits for the financial community.

But, beyond evolution and display replacement, the LED display revolution adopted by avant-garde stock exchanges, created a new meaning for them and opened up new opportunities and benefits for the stock market.

The dissemination of information in real-time, such as the operation information provided by the tickers, and live news with text, video, and graphics, everything is managed through specialized, high-end software that allows displaying the information more dynamically and efficiently.

At the same time, we refer to creating new meanings in terms of new applications and utilities. In the age of the image, the networks, the permanent interconnections in a decisive and determined social environment, and the LED Display technology offer the stock exchanges the opportunity of promoting their activities through attractive outdoor displays, which allow the social framework to give tangible form and recognize the presence of such entities.

Until recently, the market activity was likely to remain in the private sector, in buildings that expressed nothing on the outside. Due to the growth of an aesthetic sense and marketing, people likely identify the macroeconomic scenarios through a ticker placed outside the stock exchange.

At the same time, the outdoor displays provide different information, such as news and advertisements, leading to monetization and diversification of revenues with the opening of new advertising options through the displays.

-1.jpg)

Conclusion

To take advantage of the benefits and utilities of LED solutions for the stock exchanges is not an option, but rather a necessity that is addressed by the market leaders. For Latin America, the cases of the Santiago, Lima, Barcelona, and Madrid’s Stock Exchanges are paradigmatic, which have upgraded their LED systems with amazing results.

Similarly, London Stock Exchange, Dubai Financial Market, Saudi Arabia Exchange, and Nigeria Exchanges offer four outstanding examples worldwide. These markets chose Wavetec, the leading company in LED Display Solutions, to stay one step ahead of the potential that the stock market sector has to offer and to take advantage of.

BOOK A FREE DEMO