Banks are currently grappling with a fresh challenge: a shortage of bank tellers available to operate their cash counters in branches. Interestingly, this predicament is not due to a lack of labor supply but rather a shift in people’s attitudes towards monotonous jobs.

This shift can be attributed to changing dynamics in the job market and evolving expectations of the workforce. Modern-day workers, especially those from younger generations, seek roles that offer more fulfilling and stimulating experiences. They prioritize opportunities for personal growth, professional development, and a better work-life balance.

Additionally, advancements in technology and automation within the banking sector have led to the streamlining of various processes, including online banking, mobile payments, and self-service kiosks. As a result, some of the routine tasks once performed by bank tellers have been automated, reducing the need for human intervention.

No Innovation

For decades, banks have operated in more or less the same way. The last real innovation in the banking industry was Automated Teller Machines or ATMs, which ironically only automated one aspect of a teller’s job i.e., cash withdrawals.

Today, there are plenty of ATMs all over the globe, but for everything else, bank customers still have to go inside a branch and interact with human tellers. Now, the majority of a bank’s daily transactions are either deposits or withdrawals. Withdrawals are primarily automated self-service transactions, but most deposits are still handled by bank tellers.

Monotony

Cash handling has become an extremely monotonous task that requires no skill and expertise, especially in developing regions. Tellers clock in at 9, process cash and cheque deposits all day long and clock out at 5. This is all they do, 5 days a week and earn a little over minimum wage. According to Business Insider, more than 2/3 bankers are bored with their jobs.

No Enrichment or Satisfaction

With such a monotonous day-to-day, there’s barely any learning on the job hence there’s barely any prospects of growth from this point. Teller jobs have no enrichment, no growth and lead to very dissatisfied and often depressed employees. This isn’t good for organisations as it leads to diminished work ethic, increases chances of human error and increased employee turnover.

No organisation, especially a bank, wants this as it’ll lead to additional costs of hiring and retraining and not to mention the ramifications if a teller makes a mistake in cash handling. It also leads to a subpar experience for the banks customers if tellers aren’t happy doing their jobs. Wait times and customer processing times also increase leading to an overall worse customer experience.

There are several ways banks can combat this proactively and fix these issues in the short run and long run as well.

How to Deal With The Shortage of Bank Tellers in 2023

The ongoing shortage of bank tellers is a major challenge that financial institutions will continue to face in 2023. The COVID-19 pandemic has exacerbated the problem, making it difficult for banks to find qualified candidates to fill open teller positions.

Let’s explore some practical strategies and solutions that can help banks manage this shortage and ensure they continue to provide excellent service to their customers.

- Increase pay and benefits

- Incorporate Universal Teller

- Deploy self-service machines

1. Increase Pay & Benefits

The obvious fix for the short run would be to offer tellers a better overall package with a lot of perks. First off, a higher basic salary will help retention and for a while make the employee satisfied as well. Better health coverage and longer vacation days will also go a long way in employee satisfaction.

However, this is only a short run solution as the job dynamic remains the same with the same monotonous daily tasks of cash handling and check processing. To bring a real change in teller retention, a more lasting change needs to be made.

2. Universal Teller

A universal teller’s job is very dynamic, meaning, sure, they could do cash handling, but they can also handle more interactive transactions like account openings and customer-facing tasks that require a lot more personalization and that human touch.

This really enriches an otherwise monotonous job when you don’t have to stand behind a counter all day and you can work the platform, interact with customers, offer personalized services, and sell more advanced financial products.

The issue, however, is that when offered this universal teller role, employees never want to go back to their previous responsibilities i.e. traditional teller tasks like cash handling all day long. So then what becomes of the day-to-day cash and check deposit customers who seek a quick in-and-out banking experience?

3. Self-Service Machines to Deal With The Shortage of Tellers

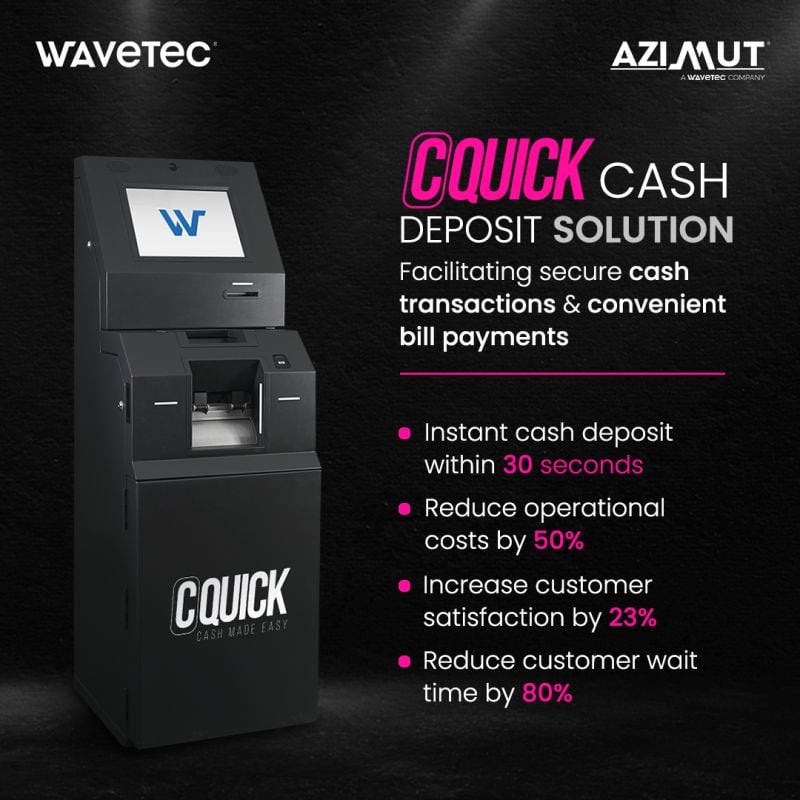

For day-to-day banking activities, there are several self-service kiosks designed specifically for cash handling so they can do deposits, withdrawals and even issue debit cards. Some manufacturers even offer kiosks that are capable of onboarding a new banking customer with full KYC and instant card issuance.

However, even just adding cash and check deposit kiosks would be enough to separate the day-to-day from the transactions that require human staff and intellect. Since most banks all over the globe already have a large network of ATMs for cash withdrawal, all they need is to automate deposits via CDMs (Cash Deposit Machines).

This means the majority of the cash-handling workflows will be automated with self-service and available 24/7, while the rest will be handled by universal tellers inside bank branches.

Check out the different types of self service kiosks available for different industries.

Tellers Still Have a Vital Role

Despite the emphasis on technology and self service channels, today’s customer still sometimes requires personalized help or guidance. And who better than a teller to administer this service? Tellers are the most experienced with customer-facing transactions in banks, and they know how to deal with every kind of customer, so there’s no one better suited for the job.

This means that some kind of teller role will always be necessary in banks, not to perform monotonous cash-handling tasks but to serve customers with more complex and personalized needs. This is one advantage traditional banks will always have over online-only banks and mobile wallets.

Customer Retention & Experience

After achieving the right balance of self-service and physical channels of service delivery, customer retention will rise as customers will have the convenience of self-service and the option to step into the branch and request more personalized services also. This omni channel approach is the way to maximize customer experience and, in turn, retention and loyalty as well.

Especially after the global health crisis, it’s important to keep your business up and running during lockdowns. Tellers are human and prone to contract illness, whereas self-service kiosks can keep your operations live without a need to open your physical branch. Gear up before the next wave by contacting our sales teams!

Case Study

Operating in a highly competitive banking landscape marked by technological advancements, Prime Bank was driven by a commitment to innovation and customer-centricity. Traditional banking processes, particularly cash transactions, presented challenges such as long queues and operational inefficiencies.

Building on the success of the pilot phase, Prime Bank systematically deployed CDMs in Kenya across its branch network, ensuring consistent implementation standards and comprehensive customer support.

Final Words

In conclusion, the shortage of bank tellers in branches is not due to a lack of available workforce but rather a shift in people’s preferences for more engaging and fulfilling job roles. To adapt to this changing landscape, banks are leveraging technological advancements and investing in training programs to meet customer needs while embracing the evolving expectations of the workforce.

BOOK A FREE DEMO